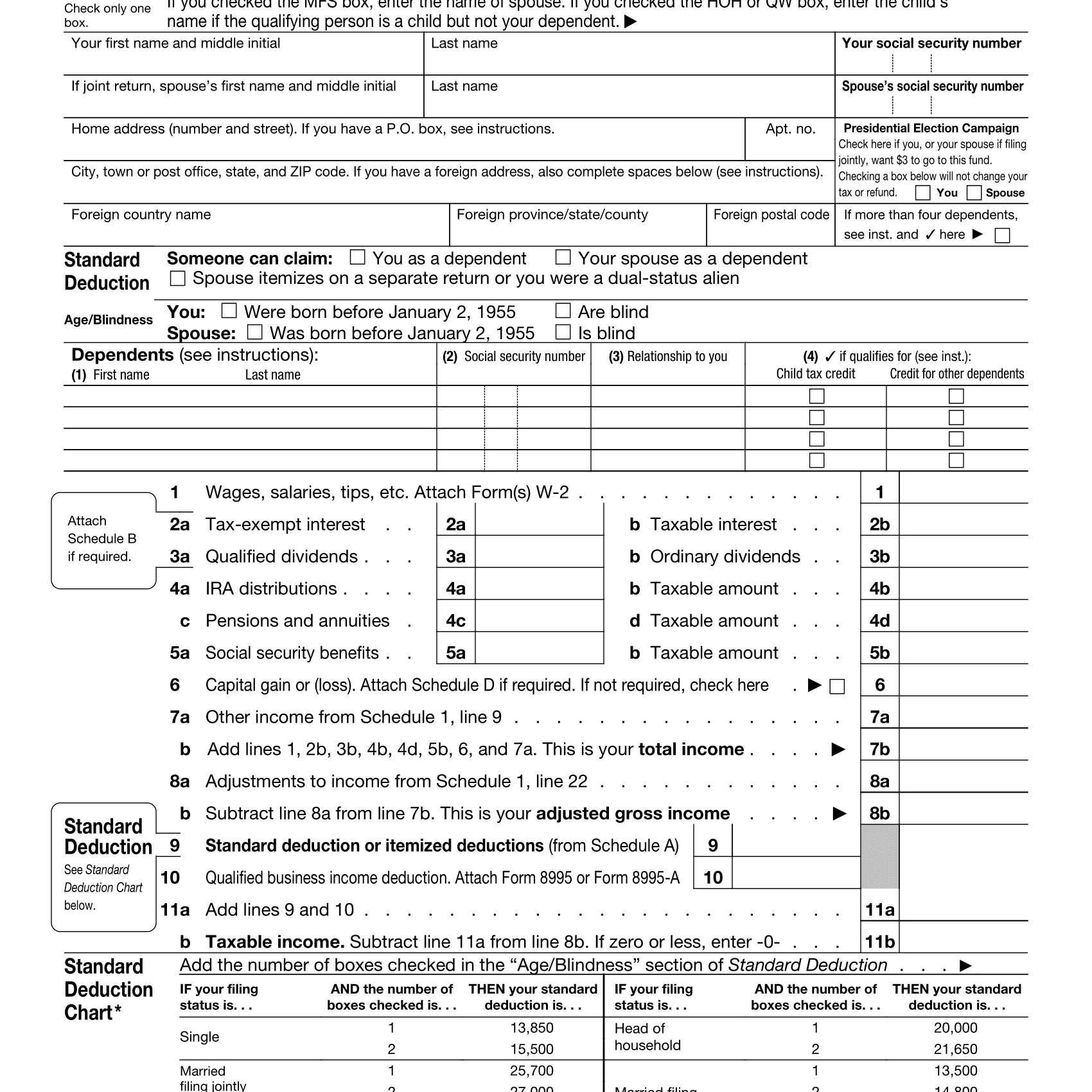

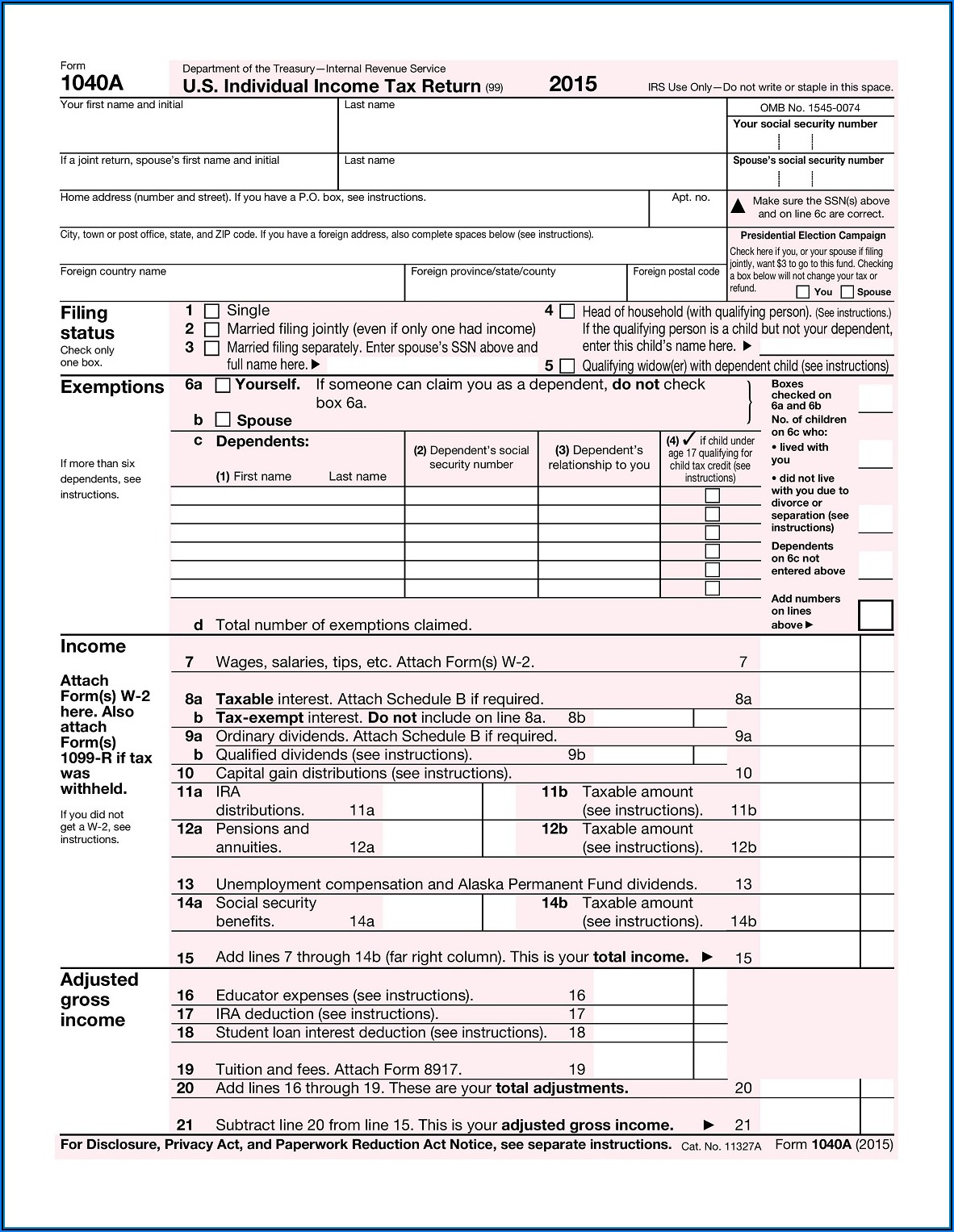

If you are an F-1 or J-1 student who arrived in the U.S. The IRS will deposit the funds into the bank account you entered on your most recent tax return. F-1 or J-1 students who qualify as tax residents for 2020 and correctly file a resident tax return on Form 1040, 1040A or 1040EZ are eligible for the Economic Impact Payments unless they are claimed as a dependent on someone else’s US. for at least 183 days in 2020, you became a resident for tax purposes in 2020 and are entitled to file a 2020 resident tax return. in F-1 or J-1 student status during 2015 and were present in the U.S. in 2014 or earlier you were a resident for tax purposes in 2019 and entitled to file a 2019 resident tax return. If you are an F-1 or J-1 student who entered the U.S. F-1 and J-1 students qualify as residents for U.S. permanent residents) are legally entitled to file resident tax returns. Individuals who qualify as residents for U.S. Unfortunately, if you filed a resident tax return in error, you may receive Economic Impact Payments to which you are not entitled. The IRS sends these payments to anyone who filed a resident tax return for 2018 and/or 2019. A second round of $600 payments is going out in late December 2020/early January 2021.

Some of you may have received a $1,200 payment in April 2020 either in the form of a paper check or a direct deposit into your bank account. Internal Revenue Service (IRS) is distributing as a result of the COVID-19 public health emergency. You are likely hearing about the Economic Impact Payments the U.S.

0 kommentar(er)

0 kommentar(er)